How much do banks usually lend for mortgages

Ad Take Advantage of Recent Rate Cuts. For example banks will lend at an average between 10 to 30.

How To Get A Loan From A Bank

They can also earn early commission and tracking where they receive some monthly payments during the.

. Low Interest Online Lenders Comparison Reviews Top Brands Free Online Offers. Compare Top Lenders Today. How Much You Can Save.

Two points on a 200000 mortgage are 2 of. Theyre generally not going to lend more than the house. Varies among lending institutions but can range in price from 300 to 500.

Its Fast Simple. The minimum investment is usually 10000. This is a percentage that shows the split between your mortgage and the loan amount after youve paid your.

A big part of the mortgage application is your loan to value ratio or LTV. As a general rule lenders want your mortgage payment to be less than 28 of your current gross income. So the debt-to-income ratio is a decent indicator of how much a mortgage lender might lend you based on your current financial.

Low Interest Online Lenders Comparison Reviews Top Brands Free Online Offers. In most cases you will need a minimum of a 5 deposit to secure a mortgage meaning youll need a 95 mortgage loan. Its Fast Simple.

DTI Often Determines How Much a Lender Will Lend. Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. In my experience its usually about 85 of the purchase price.

Quick Mortgage Lender Reviews 2022. Mortgage lenders use funds from their depositors or borrow money from larger banks at lower interest rates to extend loans. Enjoy A Stress-free Retirement And Save Using LendingTree.

Ad See How Competitive Our Rates Are. This fee is probably the most common upfront cost across the board whether youre working with a. Apply Today Save Money.

Mortgage-backed securities can be purchased at most full-service brokerage firms and some discount brokers. However there are some MBS. Just how much banks let you borrow depends on the value of the property.

Commonly lenders allow you to borrow around 45 times your income although some stretch as high as five or even 55 times of your earnings. Trusted by 1000000 Users. If you put 50 down you should be all set regardless.

So if youre buying a home with. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. How much deposit do I need to get a mortgage.

Ad See If You Qualify For Reverse Mortgage Loans. Theyll also look at your assets and debts your credit score and your employment. Exact interest rates for bank loans are based on a few factors including the loan type and borrowers.

Ad Lowest Rates Easy Online Process Side-by-Side Comparison 000 Federal Reserve Rate. The setup fees range from GBP500 to 1 of the loan amount which would probably cover the set up costs so i think its safe to say the banks are making 3 to 35 on the mortgage funds they. For example FHA loans allow you to borrow up to 975 of the homes value.

Mortgages are already paid by the mortgage lender when the loan is taken out. Ad See How Competitive Our Rates Are. Mortgage Lender Quicken Loans.

Apply Today Save Money.

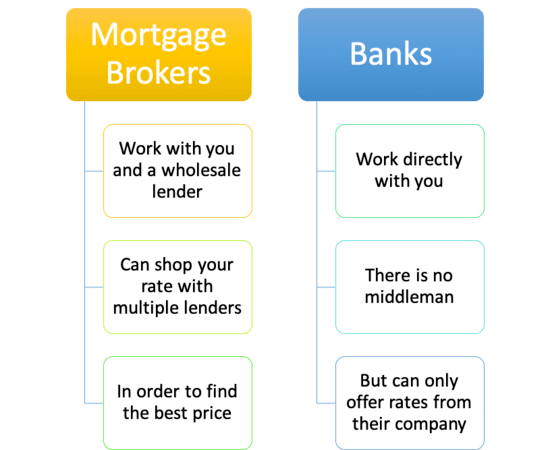

Mortgage Brokers Vs Banks

A Dummies Graphical How To Guide To Getting A Home Loan Home Buying Process Home Improvement Loans Real Estate Tips

Bank Of America Mortgage Lender Review Nextadvisor With Time

:max_bytes(150000):strip_icc()/dotdash-loan-officer-vs-mortgage-broker-5214354-Final-4c8f2e5a070a434fafcb2afa1dbe9e1b.jpg)

Loan Officer Vs Mortgage Broker What S The Difference

7 Things You Didn T Know About Australian Mortgages Mortgage Brokers Mortgage Tips Mortgage

/dotdash-loan-officer-vs-mortgage-broker-5214354-Final-4c8f2e5a070a434fafcb2afa1dbe9e1b.jpg)

Loan Officer Vs Mortgage Broker What S The Difference

20 Mortgage Statistics And Trends To Be Aware Of Fortunly

:max_bytes(150000):strip_icc():gifv()/mortgage-final-7b53158e65944796a0f896b2ff335440.png)

What Is A Mortgage

Direct Mail Letter I Assisted In Writing The Copy And Sending The Letters Writing Courses Communications Plan In Writing

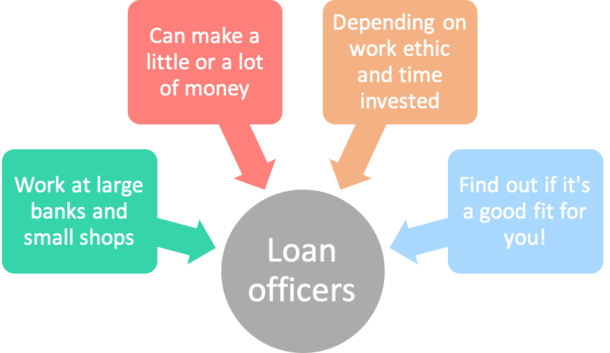

Loan Officer Job Description Expected Salary And What Your Day Will Look Like

/dotdash-mortgage-choice-quicken-loans-vs-your-local-bank-Final-03727f0a7b5648b296cd0970a5d52219.jpg)

Comparing Rocket Mortgage Vs Local Bank For A Mortgage

/dotdash-mortgage-choice-quicken-loans-vs-your-local-bank-Final-03727f0a7b5648b296cd0970a5d52219.jpg)

Comparing Rocket Mortgage Vs Local Bank For A Mortgage

Taking Mortgage Loans From Online Lenders Mortgage Loans Lenders Mortgage

Pin On Finance Infographics

How To Choose A Mortgage Lender Money

How The Federal Reserve Affects Mortgage Rates Discover

3 Types Of Personal Loans In Canada To Look In 2021 Personal Loans Loan Financial Planning